Do people really make dumb decisions…. on purpose?! That would actually be called ‘cognitive dissonance’. And certainly, people can often work against their own best interests because they follow the wrong information, based on biases. However, the topic we’re addressing today has to do with the fact that financial decisions are personal. As in, each of us has unique goals, concerns or interests. What might be okay for me, might be too risky for you because the perception of risk is also personal and experiential. Ben Carlson does a good job with this topic and we wanted to share his analysis in this article.

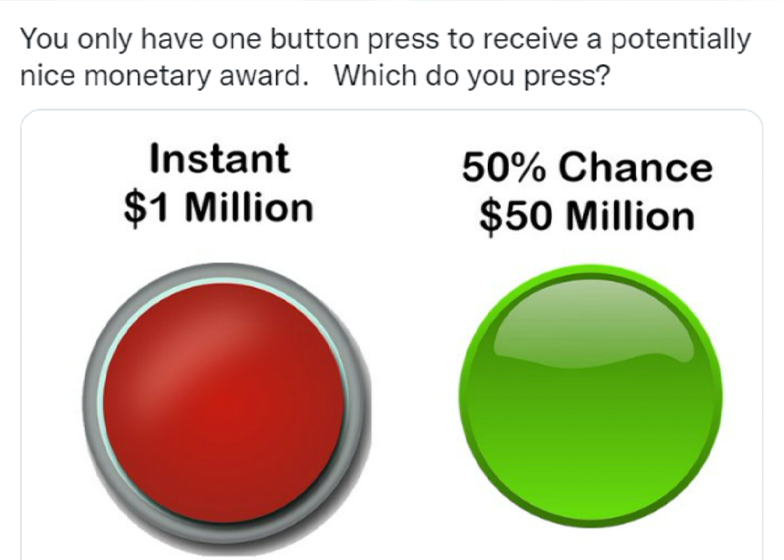

There was a question posed on Twitter this week that caused a stir among finance people:

A 50% chance of winning $50 million would equate to an expected value of $25 million. Why would you take $1 million against an expected payout value of $25 million? That doesn’t make any sense.

If you understand probabilities, you hit the green button.

Easy right?

Not so fast.

Let’s say you have $1 million in your proverbial pocket. Would you spend that money for a 50% shot at $50 million with an equal probability of losing it all?

Losses sting twice as bad as gains make us feel good. How much regret would you have if you turned down $1 million and ended up with nothing?

The mathematical answer is you hit green every time.

The psychological answer is you hit red every time.

The circumstantial answer is, well, it depends.

If you don’t have a dime to your name you should take the guaranteed million dollars all day, every day.

But what if you have some money? What if you’re already a millionaire? At that level of wealth taking the 50/50 shot at $50 million might be far more tempting.

Circumstances tend to trump math when making big money decisions.

Daniel Bernoulli was a mathematician and physicist from the 18th century. One of his enduring ideas is that real-life decisions are more about consequences than facts, especially when dealing with an uncertain future.

Bernoulli once wrote, “The utility [of probabilistic decisions] is dependent on the particular circumstances of the person making the estimate. There is no reason to assume that the risks anticipated by each [individual] must be deemed equal in value.”

In other words, circumstances matter. Risk is personal.

A probabilistic experiment conducted in a vacuum will yield far different results than real-world decisions that involve real-world money.

It’s also true that most financial decisions we make don’t have probabilities that are set in advance. There is always an element of uncertainty in the equation.

And even if we could estimate the odds of specific money decisions it might not always make sense to take the one with the highest expected value.

Sometimes happiness, comfort, satisfaction or safety trump dollar signs. Math is good for maximizing probabilistic games but not always in real life.

In the 1990s the military needed to right-size its headcount after the end of the cold war. So they gave more than 65,000 enlisted men and women the choice between a lump sum and an annuity that would pay them periodically for their pension.

Researchers studied the decisions and discovered more people took the lump sum than the annuity. Using prevailing government bond yields at the time, they calculated the present value of the annuity stream offered by the government to be $4.2 billion.

The actual annuity payments plus the lump sums paid out totaled $2.5 billion.

This means these people left $1.7 billion on the table.1

What were these people thinking?!

Maybe they were financially illiterate. Maybe they got bad advice. Maybe they didn’t understand the trade-offs.

I’m sure this was the case for some of these people.

Or maybe, just maybe, some people made the right decision for their own personal circumstances and needed the money for one reason or another.

Not all financial decisions need to be driven exclusively by present values or discounted cash flow analysis.

I posed my own question on Twitter this week based on a reader email:

Read the comments. A lot of people chimed in, many certain of their answers.

You have to do it! There is no mortgage rate that’s more important than family.

Don’t even think about it! Make the kids sleep on bunk beds. A big house is not worth it.

Just buy a new house and rent out the old place with a low mortgage rate. That way you never let it go.

The problem with a big decision like this is there is no perfect answer. Each option could be right for the right family under the right circumstances.

I understand why some people would be reluctant to give up the best mortgage rate of their lifetime. I also understand why other people would suck it up and move, regardless of the interest rate.

Life is more about shades of gray than black or white when thinking through these kinds of problems.

We don’t get to test drive our financial lives in some experiment where we get to perform Monte Carlo simulations thousands of times to figure out the optimal path with the highest probability for success.

There are no counterfactuals in the real world and few opportunities to practice making the biggest money decisions.

You have to take into account your current circumstances, appetite for risk, financial situation, potential for regret and happiness when working through difficult money decisions.

Sometimes people make dumb financial decisions on purpose because it makes sense for them even if it doesn’t make sense to you.

To each their own.

As Ben has pointed out, each of us has a way of evaluating, not only risk, but reward. And that objective evaluation can be difficult on your own. It’s impossible to see the future and you don’t know what you don’t know. This is why having a sounding board – an advisor interested in working with you to figure things out – can help you avoid leaving money on the table… or to the wrong people.

Best regards,

– J’Neanne